Gold prices recorded a significant drop on Monday in both the international bullion market and the Pakistani market, driven by a global decline in precious metals.

According to the All-Pakistan Gems and Jewellers Sarafa Association (APGJSA), the international price of gold per ounce fell by $36, settling at $3,361. The drop was reflected in domestic markets, with the price of 24-karat gold in Pakistan falling by Rs 3,600 per tola, bringing the new rate to Rs 358,800.

Local Gold Rates Decline

The price of 10 grams of gold also decreased sharply, dropping by Rs 3,086 to Rs 307,613. This marks one of the steepest daily declines in recent weeks.

On Saturday, gold had already seen a slight dip of Rs 300 per tola, closing at Rs 362,400. The latest price drop represents a more significant downward shift in line with international market trends.

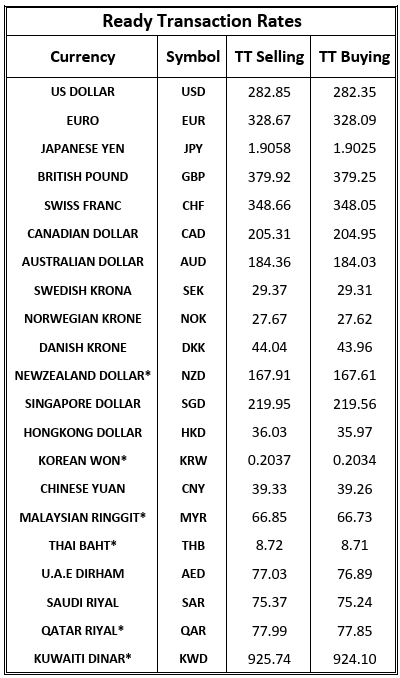

Current domestic precious metal rates (APGJSA, August 12, 2025):

| Metal | Per Tola Price | 10 Gram Price |

|---|---|---|

| Gold (24k) | Rs 358,800 | Rs 307,613 |

| Silver | Rs 4,013 | Rs 3,440 |

Silver and Other Precious Metals

Silver prices in Pakistan also saw a decline, with the per tola price falling by Rs 51 to Rs 4,013. The 10 gram silver rate dropped by Rs 44 to Rs 3,440.

In international markets, spot silver fell 1.1% to $37.89 per ounce. Platinum dropped 1.3% to $1,314.73, while palladium saw a slight increase of 0.4%, reaching $1,131.55.

Global Market Overview

Spot gold traded 1.1% lower at $3,362.21 per ounce by 0839 GMT after briefly touching its highest level since July 23. Analysts say the fall comes amid fluctuations in global demand, a stronger US dollar, and profit-taking by investors after recent highs.

Gold’s premium in Pakistan remains around $20 per ounce compared to the international market, due to import costs and local market adjustments.

Why It Matters for Investors and Jewellers

The latest drop in gold and silver prices could benefit buyers looking to invest in precious metals, while posing a challenge for traders who purchased stock at higher rates.

Industry experts suggest that prices could remain volatile in the coming weeks, depending on global economic signals, currency movements, and investor sentiment in major markets.