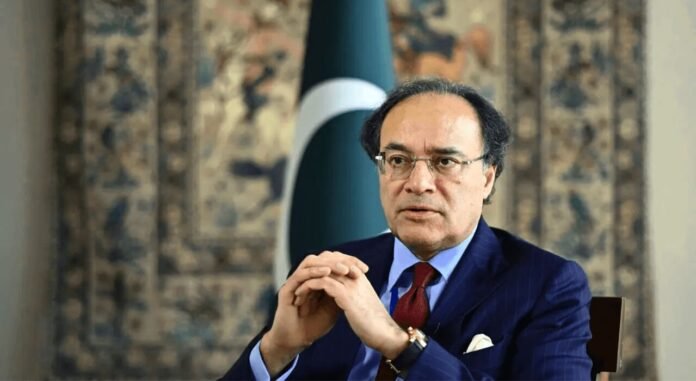

Pakistan is preparing to re-enter international capital markets through the issuance of a Panda bond, Finance Minister Muhammad Aurangzeb announced on Wednesday. Speaking at the CIPFA-ICAP Public Financial Management Conference 2025 at Serena Hotel in Islamabad, he said the inaugural yuan-denominated bond could be launched before the end of this year coinciding with Prime Minister Shehbaz Sharif’s upcoming visit to China.

Pakistan’s Panda Bond Plan

Aurangzeb confirmed that the government is finalising steps for the Panda bond Pakistan issuance date expected in late 2025. The instrument will be denominated in Chinese yuan giving Pakistan access to China’s onshore bond market and expanding its external financing sources.

According to him, Pakistan may also explore the Global Medium-Term Note (GMTN) market if sovereign credit ratings and bond spreads continue to improve.

Bloomberg earlier reported that Pakistan is preparing yuan-denominated bonds this year while Reuters highlighted that Islamabad could raise up to $1 billion in international bonds during FY2025/26 with the first Panda bond tranche estimated at $250–300 million.

Strengthening External Financing

Aurangzeb disclosed that Pakistan has requested an expansion of its swap line with China from 30 billion to 40 billion yuan ($1.4 billion). This step, he said, would help stabilise reserves and support the Panda bond’s launch.

He added that Pakistan is also working with the Asian Infrastructure Investment Bank (AIIB) and the Asian Development Bank (ADB) to secure credit enhancements aimed at lowering borrowing costs and improving investor confidence.

“Economic stability is a means to an end. What matters is staying the course and avoiding another boom-bust cycle,” the finance minister told the conference audience.

Ratings and Market Sentiment

Aurangzeb highlighted that the alignment of global credit rating agencies—Fitch, S&P and Moody’s is a “positive signal” for Pakistan’s economic direction. Improved ratings could pave the way for wider access to global capital markets including dollar and euro-denominated bonds under the GMTN programme.

Analysts say that re-entering the international bond market after years of absence will test investor confidence in Pakistan’s reforms particularly as the country navigates external financing challenges in 2025.

Domestic Reforms

On domestic policy, Aurangzeb clarified that the Federal Board of Revenue (FBR) will focus only on tax administration while the Finance Division will lead policymaking. He also underlined the importance of privatisation noting that 24 state-owned enterprises (SOEs) are currently listed with the Privatisation Commission.

“We need to rightsize and privatise where possible. This will reduce corruption and save the national exchequer,” he said.

The minister also stressed the urgency of climate-friendly investment calling for regional and international partners to help Pakistan identify “investable and bankable projects” that align with climate resilience.

Why This Matters

Pakistan’s move to issue a Panda bond signals its attempt to diversify financing sources, reduce reliance on traditional markets and strengthen economic ties with China. If successful, this issuance will mark Pakistan’s re-entry into global debt markets after years of limited access due to credit downgrades and balance-of-payment crises.

The bond, along with swap line expansion and reforms in taxation and SOEs could improve Pakistan’s liquidity position and signal to investors that Islamabad is serious about stabilising its finances.

Key Numbers at Glance

- Panda Bond size (first tranche): $250–300 million

- Total international bonds targeted (FY2025/26): Up to $1 billion

- Swap line request with China: 40bn yuan (from 30bn) ≈ $5.5bn

- Swap line expansion sought: 10bn yuan ($1.4bn)

- SOEs under privatisation: 24